China Online Education (COE) Stock: What's The Buzz?

Could the fluctuating fortunes of China Online Education Group (NYSE: COE) offer a window into the broader complexities of investing in a rapidly evolving global landscape? The recent downturn in the company's stock price, coupled with China's regulatory shifts, presents a compelling case study for understanding the interplay of market forces, geopolitical influences, and the ever-changing dynamics of the education sector.

The current quarter has seen a noticeable shift in sentiment surrounding China Online Education Group, with the stock down a considerable 31% in the last month. This decline continues a difficult period for the company, causing understandable concern among shareholders. The volatility raises important questions about the factors influencing investor confidence and the potential risks faced by those involved in the company.

To understand the context, consider the core business: 51Talk Online Education Group (the current name, formerly China Online Education Group) offers online English language education services. Operating through subsidiaries, it caters to students across China, Hong Kong, the Philippines, Singapore, Malaysia, and Thailand. Their platform enables live, interactive English lessons with overseas foreign teachers, accessible via online and mobile platforms. This model has been the backbone of the company since its founding by Jia Jia, allowing for broader accessibility for students.

| Aspect | Details |

|---|---|

| Company Name (Current) | 51Talk Online Education Group |

| Former Name | China Online Education Group |

| Ticker Symbol | COE (NYSE) |

| Founded | 2011 |

| Founder | Jia Jia |

| Headquarters | Singapore |

| Core Business | Online English Language Education Services |

| Geographical Reach | China, Hong Kong, Philippines, Singapore, Malaysia, Thailand |

| Service Type | Live interactive English lessons with overseas foreign teachers, small group lessons. |

| Platform | Online and mobile education platforms |

| Significant Policy Impact | Chinese government's new policy directives regarding online and offline tutoring services (July 24, 2021) |

| Recent Developments | Entered into a share purchase agreement with Dasheng Holding (HK) Limited on June 24, 2022. |

The dramatic downturn in the stock raises several important questions. One is: what are the potential impacts of geopolitical tensions and global debates on Chinas policies on investor sentiment towards COE? The answer is complex. The company operates within the framework of China's economic and regulatory environment. Chinas educational policies are subject to frequent adjustments, particularly concerning online tutoring services. Government policies directly impact how educational providers operate. The sector's reliance on international collaboration adds another layer of complexity. International relations, trade tensions, and global perceptions of China all come to bear on investor confidence in this sector.

Further complicating matters is the volatility inherent in the stock. What are the potential risks of COE's high volatility for day traders in the short term? The short-term investor, or day trader, faces a different set of challenges. High volatility can present opportunities for profit, but it also significantly increases risk. Price swings can be rapid and unpredictable, necessitating rigorous risk management strategies. The inherent uncertainty surrounding regulatory changes and the political climate can amplify these risks, potentially leading to substantial losses.

The challenges are not limited to the immediate financial landscape. The sector is in many ways a reflection of Chinas ambition to make educational opportunities more widely available. Education is a critical aspect of societal development, influencing future generations' views and values. Debates on educational systems, including the challenges they face, are essential. The sector is further complicated by the competitive dynamics within the online education market.

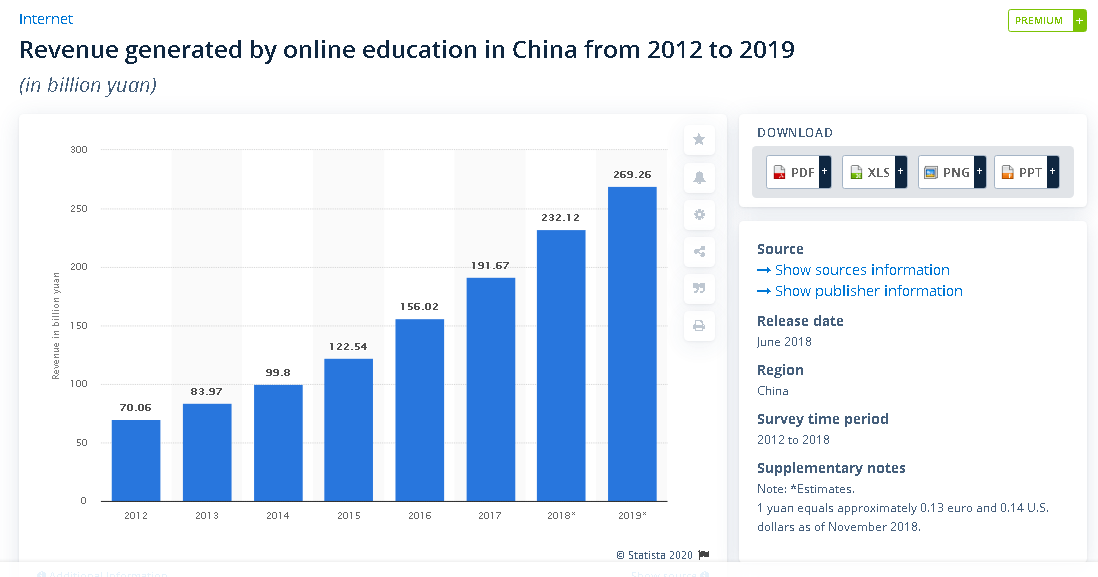

In this environment, analyzing market performance and understanding the factors influencing share value is crucial. The company's revenue streams are part of a wider market, projected to reach US$45.35 billion in 2025. The growth of online education is driven by increasing internet penetration, the demand for flexible learning options, and advancements in educational technology. However, this expansion also brings regulatory challenges and a competitive environment, all contributing to the risk factors for the company.

The 51Talk Online Education Group offers both English and Chinese lessons. The company's goal is to offer education in an accessible and affordable manner. They enable students across china to access interactive live lessons from overseas teachers. The company, which changed its name from China Online Education Group to 51Talk Online Education Group in September 2022, was founded in 2011 and is based in Singapore. The core focus remains delivering English Language education, including small group classes.

One critical element to consider is the effect of Chinese government policy. The policies issued on July 24, 2021, had a dramatic impact on tutoring for students, and they have significantly reshaped the operational landscape of online education providers. Understanding these policies is crucial for evaluating both short-term risks and long-term opportunities for companies operating in this sector.

The analysis of China Online Education Group offers insight into the current investment landscape, including its volatility and regulatory pressures. The stock's performance, influenced by broader economic conditions and political circumstances, directly affects investors. In recent months, the company has seen decreased support from institutional investors. This underscores the crucial need for investors to carefully assess the risks and potential rewards.

Understanding these influences, along with the market trends within China, will become increasingly relevant as the company continues to evolve. The company's prospects rely on its ability to manage these complex variables.

For those watching the education sector, the trajectory of China Online Education Group provides a focal point. The factors that affect the company's future are likely to continue to evolve, adding to the necessity of comprehensive analysis and well-informed decisions.

The data also shows the involvement of hedge funds, indicating a degree of interest from professional investors despite the stock's recent struggles. The decisions made by these elite money managers can offer insights, but as always, it is essential to evaluate the complete picture. Whether you are a seasoned investor or new to the stock market, careful research and understanding are key to navigating the dynamic world of online education in China.