Mid Oregon Digital Banking: Secure & Easy Access - Learn More

Are you looking for a banking experience that puts you in control, offers unparalleled security, and simplifies your financial life? The future of banking is here, and it's accessible right at your fingertips with advanced digital platforms designed for today's fast-paced world.

Navigating the complexities of modern finance can be daunting, but with the right tools and strategies, managing your money becomes a seamless and empowering experience. Digital banking platforms offer a comprehensive suite of features designed to streamline your finances, providing greater flexibility, enhanced security, and a more intuitive user experience. These platforms are not just about convenience; they're about providing you with the knowledge and control you need to make informed financial decisions. Whether you're a seasoned investor or just starting to build your financial foundation, understanding the benefits of these platforms is key.

The integration of digital tools has revolutionized the way we interact with our finances. Gone are the days of waiting in line at a physical branch or sifting through paper statements. With digital banking, you have instant access to your accounts, allowing you to monitor your spending, transfer funds, and pay bills from anywhere, at any time. This level of accessibility is a game-changer, especially for those with busy schedules or those who value the convenience of managing their finances remotely.

One of the core advantages of these digital platforms is the enhanced security measures implemented to protect your financial information. Banks and credit unions invest heavily in advanced encryption and fraud detection systems, ensuring that your data remains safe and secure. These measures provide peace of mind, knowing that your sensitive information is protected from unauthorized access. Digital banking platforms are constantly evolving, incorporating the latest security protocols to stay ahead of emerging threats and vulnerabilities.

Beyond the convenience and security, digital banking platforms also offer a range of sophisticated tools designed to help you manage your money more effectively. These tools include budgeting features, spending trackers, and financial wellness widgets that provide valuable insights into your spending habits and help you set and achieve your financial goals. Whether you're saving for a down payment on a house, paying off debt, or planning for retirement, these tools can empower you to take control of your financial future.

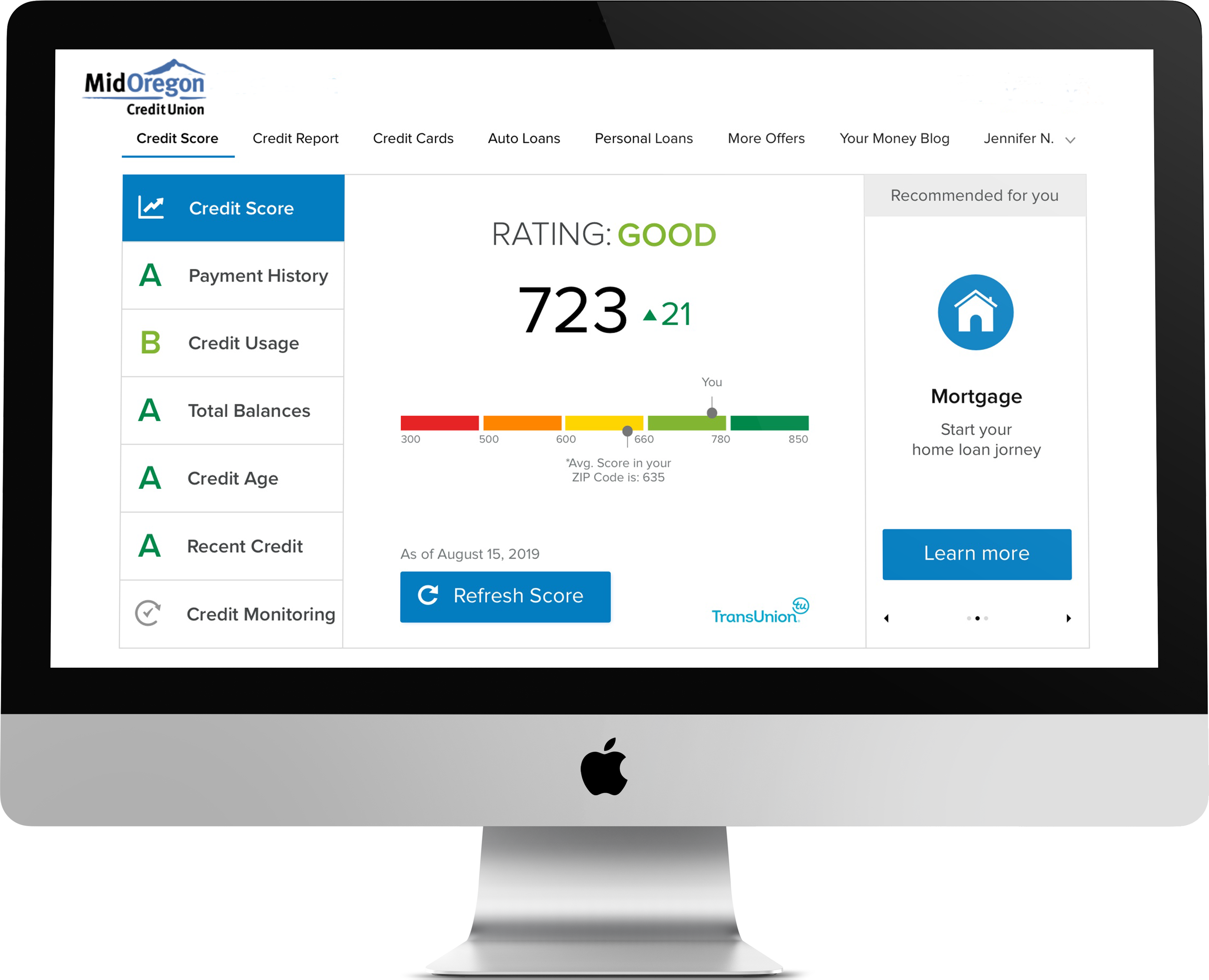

Consider Mid Oregon Credit Union's digital banking platform. It exemplifies the features found in today's state-of-the-art banking system.

| Feature | Description |

|---|---|

| Account Access | View balances, transaction history, and manage your accounts from anywhere with an internet connection. See all your accounts in one place! |

| Fund Transfers | Transfer funds between your accounts, to other members, or to external accounts. You can even transfer funds to another member. ATM balance transfer allows you to move money between accounts. |

| Bill Payment | Pay bills online, set up recurring payments, and track your payment history. Transfer between accounts, or pay bills on the go! |

| Mobile Banking | Access your accounts, make transactions, and manage your finances from your smartphone or tablet. Free mobile banking, ebillpay, estatements, and more! |

| Check Deposits | Deposit checks remotely using your smartphone or tablet. Digital banking view balances, deposit checks, transfer funds, and pay bills. |

| Loan Payments | Make payments to your Mid Oregon loan using another credit or debit card instantly with payonline service. |

| Security Features | Enhanced security measures, including encryption, fraud detection, and multi-factor authentication, to protect your financial information. Keep your login credentials secure using these best practices. |

| Budgeting Tools | Track and categorize your spending to meet your budget goals with the financial wellness widget. Use this free tool to help you track and categorize your spending. |

| Financial Insights | Analyze your spending by category with the financial wellness widget to create your budget. The financial wellness widget in mid oregons digital banking platform enables you to easily view and analyze your spending by category, helping you to meet your budget goals. |

| Free Credit Reports | Access free credit reports using Credit Savvy, building and tracking your spending and savings goals. The standard features you would expect, plus free credit reports using credit savvy, building and tracking your spending and savings goals! |

| Account Management | Convert your information over to our new digital banking platform to keep your account management in sync using quicken and quickbooks. |

These are standard features of a modern digital banking platform, allowing the user to simplify the day-to-day management of funds and account security. The integration with personal financial management tools adds a new dimension of control over spending.

The digital banking platform is built to be an extension of the credit unions existing services, such as overdraft protection, direct deposit, and wire transfers. Mid Oregon provides members with credit union services such as overdraft protection, direct deposit and wire transfers.

These features offer a streamlined approach to account management, while also offering services with security features.

Activating your card within digital banking is a seamless process. Activate your card easily right within digital banking. Follow the steps below to get started!

The digital banking platform provides a more streamlined way to view all your accounts. Mid oregon credit union's digital banking platform: More flexibility transfering money from account to account, more security, a more streamlined way to view all your accounts, and many great tools. A personalized experience with the maximum level of account security. Open online or in person.

Mid Oregon offers free checking accounts, including simply free checking, with free online banking.