Mid Oregon Digital Banking: Features & Benefits You Need

Are you tired of juggling multiple bills, managing accounts, and worrying about financial security? Embrace the ease and control of modern digital banking and discover how it can revolutionize your financial life.

The world of finance is rapidly evolving, and digital banking has emerged as a powerful tool for individuals and businesses alike. It offers a convenient, secure, and efficient way to manage your money, access services, and stay in control of your financial well-being. Let's delve into the specific advantages and features offered by institutions like Mid Oregon Credit Union, while also exploring the broader benefits of digital banking in today's landscape.

One of the most appealing aspects of digital banking is the freedom it provides. You can access your accounts and conduct transactions from anywhere with an internet connection, 24 hours a day, 7 days a week. This level of accessibility eliminates the need to visit physical branches during limited business hours, saving you time and effort. Whether you're at home, at work, or traveling, your financial information is just a few clicks away. This accessibility is a hallmark of Mid Oregon Credit Union's digital banking platform, which offers users unparalleled control over their finances.

Let's explore some of the key features and benefits of digital banking as offered by Mid Oregon Credit Union:

Free Checking Accounts and Online Banking: Mid Oregon Credit Union offers free checking accounts, including their "Simply Free Checking" option. This is coupled with free online banking, providing a solid foundation for your financial management. This means you can access all the core features of digital banking without incurring fees, making it an attractive option for those seeking cost-effective banking solutions.

Comprehensive Account Management: Through the digital platform, you can view your account balances, deposit checks remotely, transfer funds between accounts, and pay bills all from the comfort of your home or on the go. This streamlines your financial management, allowing you to keep track of your finances and make informed decisions.

Bill Payment Automation: One of the standout features is the ability to enter all your bills at once and set them up for automatic payments each month. This ensures that you never miss a payment deadline, avoiding late fees and potential damage to your credit score. The convenience of automated bill pay is a significant time-saver and provides peace of mind.

Secure Access to Statements: Say goodbye to paper statements cluttering your mailbox. You can securely view, download, and print your account statements online. Furthermore, Mid Oregon Credit Union offers eStatements, which can be accessed through online banking in a safe and secure manner. These statements are archived for 24 months, providing a convenient historical record of your transactions. You'll also receive an email alert when your statement is ready to view, ensuring you stay informed.

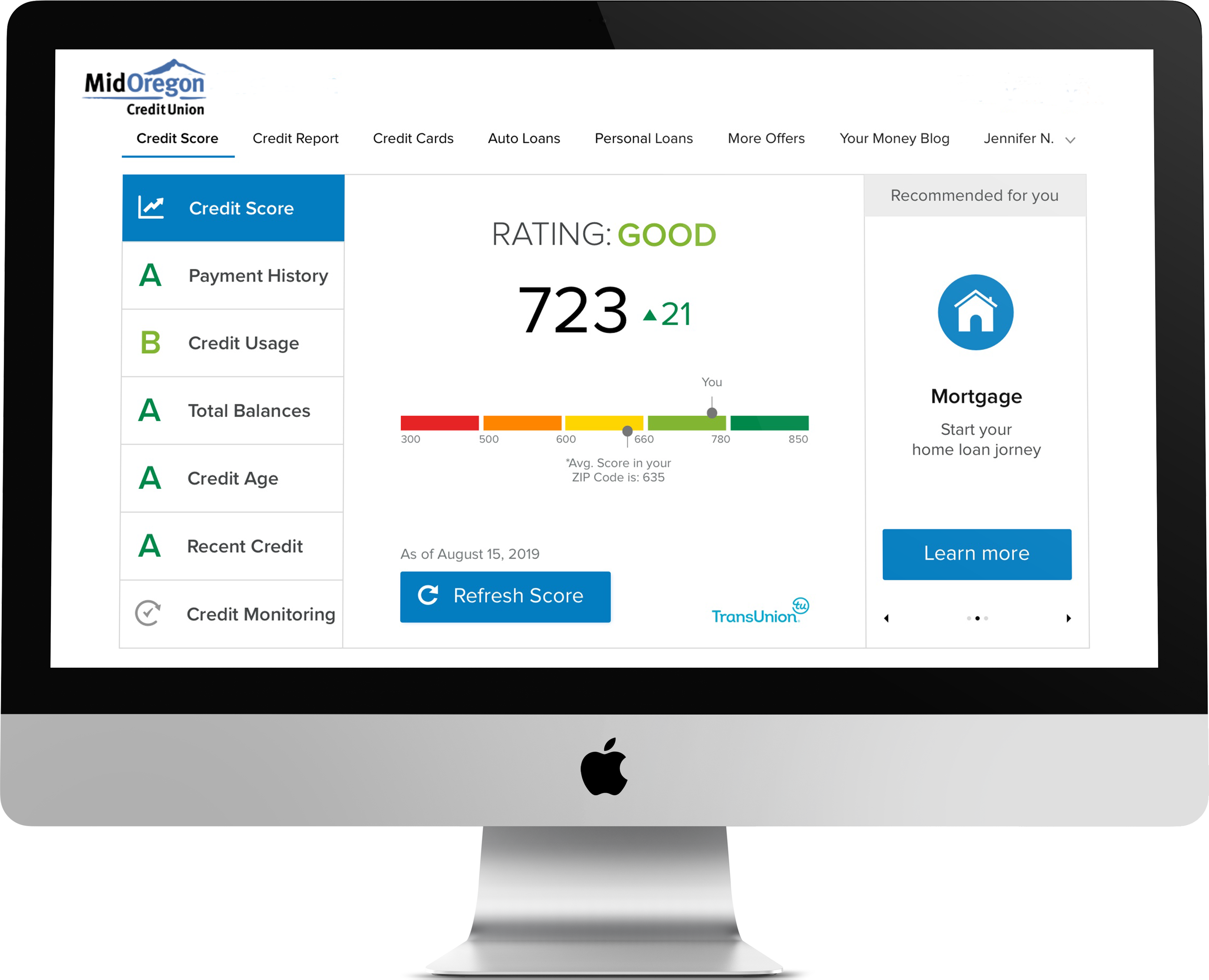

Financial Wellness Tools: Digital banking platforms often incorporate tools to help you manage your finances more effectively. For instance, you can get your free credit score daily, set up alerts to prevent identity fraud, and learn ways to improve your credit score. These tools empower you to take control of your financial health.

Mobile Banking: Mid Oregon Credit Union provides free mobile banking, giving you the flexibility to manage your finances from your smartphone or tablet. This allows you to deposit checks, transfer funds, and pay bills on the move. This is especially useful for individuals with busy lifestyles.

Secure Payment Options: Make payments to your Mid Oregon loan or credit card quickly and securely using a debit or credit card from another financial institution. This is a convenient way to manage your payments and maintain good standing with your credit union.

Business Banking Services: Mid Oregon Credit Union extends its digital banking services to commercial clients, helping businesses manage their finances efficiently. They offer various services designed to support the unique financial needs of businesses.

User-Friendly Interface: The new digital banking platform from Mid Oregon Credit Union boasts new and more secure features, making it easier for users to manage their accounts. Switching over from the current online banking platform is also quick and easy, taking only a couple of minutes for existing users.

Integration with Financial Software: For users who use financial software like Quicken or QuickBooks, Mid Oregon Credit Union provides information on how to convert your data from your previous online banking platform. This ensures a smooth transition and minimizes disruption.

Key Features of Digital Banking: A Closer Look

Let's breakdown the core features of digital banking:

- Account Management:

- View account balances in real-time.

- Review transaction history (deposits, withdrawals, transfers).

- Manage multiple accounts (checking, savings, loans, credit cards).

- Bill Payment:

- Schedule and pay bills online.

- Set up recurring payments.

- Track payment history.

- Fund Transfers:

- Transfer money between your own accounts (checking to savings, etc.).

- Transfer money to other individuals (P2P payments like Zelle, Venmo).

- Initiate transfers to and from external accounts.

- Mobile Banking:

- Deposit checks remotely (mobile check deposit).

- Access account information on the go.

- Receive push notifications for transactions and alerts.

- Manage your finances from your smartphone or tablet.

- Security Features:

- Multi-factor authentication (MFA) and biometrics (fingerprint, facial recognition).

- Encryption of data during transactions.

- Fraud alerts and real-time monitoring.

- Alerts and Notifications:

- Receive alerts for low balances, large transactions, and upcoming payments.

- Customize alert preferences.

- Stay informed about your account activity.

- eStatements:

- Access and download electronic statements.

- Reduce paper clutter.

- Easily search through past statements.

- Customer Support:

- Secure messaging with bank representatives.

- Access to FAQs and help articles.

- Contact information for phone and email support.

The Benefits of Digital Banking

Digital banking offers numerous advantages over traditional banking methods:

- Convenience: Access your accounts anytime, anywhere. Conduct transactions without visiting a branch.

- Efficiency: Save time with automated bill pay, mobile check deposit, and quick fund transfers.

- Cost Savings: Reduce or eliminate fees associated with traditional banking services (e.g., paper statements, transaction fees).

- Enhanced Security: Benefit from robust security measures like multi-factor authentication and fraud monitoring.

- Improved Financial Control: Monitor your spending habits, track your progress toward financial goals, and make informed financial decisions.

- Environmental Friendliness: Reduce your carbon footprint by utilizing paperless statements and reducing the need for travel.

- Accessibility: Digital banking can be especially helpful for individuals who find it difficult to visit physical branches due to mobility issues or other constraints.

Getting Started with Digital Banking at Mid Oregon Credit Union

If you're a member of Mid Oregon Credit Union, or are considering becoming one, the process of accessing and utilizing digital banking is straightforward.

Existing Users:

If you're already a user of Mid Oregon Credit Union's online banking, transitioning to the new platform should only take a few minutes. The Credit Union provides clear instructions and support to ensure a seamless switch. You can start by converting your existing Mid Oregon online banking login.

New Users:

If you are new to Mid Oregon, the first step is to become a member. You can open an account online or in person at one of their branches located in Bend, Redmond, La Pine, Sisters, Madras, or Prineville. Once you're a member, you can easily register for online and mobile banking. Click the green button (likely on their website or app) to register or download the mobile app and follow the simple steps to get started.

Essential Steps to Securing Your Digital Banking Experience:

While the convenience of digital banking is clear, it is important to prioritize security. Here are some essential measures to take:

- Strong Passwords: Use complex passwords that include a combination of upper and lowercase letters, numbers, and symbols.

- Two-Factor Authentication (2FA): Enable 2FA whenever it's offered. This adds an extra layer of security by requiring a code sent to your phone or email.

- Secure Networks: Avoid using public Wi-Fi for sensitive transactions. Utilize a secure, private network.

- Keep Software Updated: Ensure your computer and mobile devices have the latest security updates.

- Monitor Accounts Regularly: Check your account activity frequently and report any suspicious transactions immediately.

- Be Wary of Phishing: Never click on links or open attachments in suspicious emails or text messages.

- Install Anti-Virus Software: Protect your devices from malware and viruses.

Mid Oregon Credit Union - Local Presence, Comprehensive Services

Mid Oregon Credit Union is deeply rooted in Central Oregon, offering a range of financial services. They offer free checking, auto and home loans, online banking, investing options, business banking, and financing solutions. With branches spread across Bend, Redmond, La Pine, Sisters, Madras, and Prineville, they provide accessible and personalized financial services.

Mid Oregon Credit Union's commitment to its members extends to providing robust commercial services. If you are a business owner, you can keep your business running with excellent services tailored to meet your financial needs. They offer a full range of commercial services.

Converting your Quicken/QuickBooks information

For those looking to move from a prior online banking platform, or already using financial software like Quicken or QuickBooks, the transition process is made simple, the credit union provides resources to easily convert your data.

In conclusion, digital banking, as exemplified by the offerings of Mid Oregon Credit Union, is more than just a trend; it's the future of personal and business finance. By embracing the convenience, security, and efficiency of digital banking, you can take control of your finances and achieve your financial goals with ease. Take advantage of the free features, financial wellness tools, and mobile banking options that Mid Oregon Credit Union offers to make managing your money easier than ever.